At the moment you can finance a car with a salvaged title, however this may not always be possible depending on why the car had a salvaged title in the past. This means that it is likely that some banks will refuse to give you money for your car.

Can You Get A Rebuilt Title Loan From The Bank?

At the moment, banks also provide a rebuilt loan if the vehicle has not been seriously damaged and has not been in a major accident in the past.

What Is a Rebuilt Title?

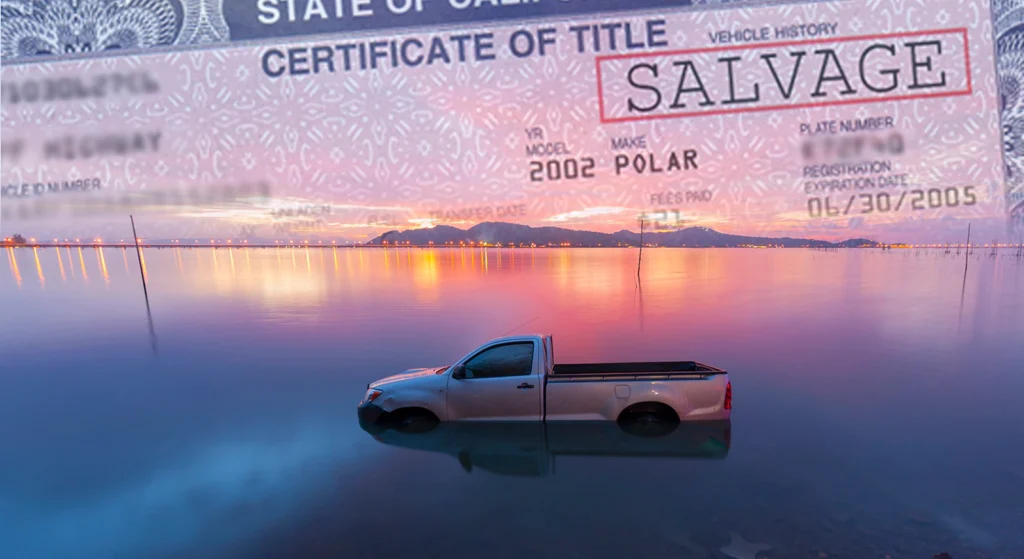

Before answering the question of whether it is possible to get a loan on a rebuilt title, it is first important to understand what such a thing would entail. This applies to cars that were previously declared unrepairable and fully destroyed by insurance companies due to injury sustained in an accident. By looking more closely at this concept, we find out that rebuilding actually implies repairing or restoring something back to its original form or functioning state.

After meeting all requirements imposed by law as well as passing testing provided by DMVs (the Department of Motor Vehicles), one may apply for the final certificate of ownership entitling them to operate their car once again. For this reason, understanding what a rebuilt title entails becomes essential before attempting anything without thorough knowledge of specifics pertaining to applying for such restoration – especially considering how differences between things like repaired and cleaned titles could cause issues along the way and alter completion rates or prospects entirely.

Can You Finance A Car With A Rebuilt Title?

Source: cars.com

Nowadays, more and more people are wondering if they can get a loan on a rebuilt title; and the short answer is yes. But be aware that it will depend heavily on what caused the car to have a salvage title before. And it also depends on the damage to the car that resulted from an accident; so you’ll need to check its history by VIN.

First of all, keep in mind that when we talk about rebuilt cars, these vehicles have been fixed up and are completely safe for driving. Furthermore, it’s important to note that since this type of vehicle was previously damaged in some way or another – they’ll naturally lose some value. But this doesn’t bother lenders as long as they know what happened to the car prior – because they’re uncertain how much damage was done or how well repairs were handled – which is why many lenders refuse loans on rebuilt cars without them being evaluated first.

Can I Get a Rebuilt Title Loan?

You most likely know that when you apply for a Title Loan (you can read more about it on this site), you can get no more than 50% of its value.

You probably already know that when you apply for a Title Loan (check out our website) the amount you are eligible to receive is usually only around 50% of the vehicle’s value. Furthermore, even if the vehicle has been in an accident and there was no major damage done but just a few scratches or dents, insurance companies won’t give more than 60% of the cost back because they assume there were major repairs made.

This means that lending money on cars with a rebuilt title can be quite risky to lenders because they assume these cars have been extensively repaired before – so making regular monthly payments might be difficult. However, if you can provide evidence of having a steady income as well as good credit history, then you should be able to secure financing despite having a rebuilt title.

Which Rebuilt Title Vehicles Can Be Financed?

Source: capitalone.com

You may have heard that in the past banks have suffered heavy losses by financing vehicles whose salvage history they did not know. However, as already mentioned, now they can access the VIN reports and find out about the condition of the car.

That is why, most often, banks still finance vehicles with a rebuilt title if they had minor damage or were restored after theft. They agree to provide loans because they know that the car has not previously suffered serious damage and it will still be in working condition until the loan with interest is fully repaid. What’s more, in some states, banks and loan companies can provide 50% of the value of a rebuilt vehicle.

Should You Fund A Rebuilt Title Car?

You are sure to realize that submitting a vehicle with a rebuilt title is a rather complex task. As a result, paying off a loan for a car that will be hard to get rid of is probably not the wisest idea. So, if you apply for a Title Loan with a regular title, after paying off the loan with interest in full, you will still have a car in a sufficient enough state that you’ll be able to sell it easily. However, in the case of a rebuilt car, you are likely to face certain difficulties getting rid of it in order to obtain financing.

Important! First of all, you should pay attention to the type of damage that was received. If the car has only had cosmetic repairs, then getting a loan isn’t such a bad idea, as you can sell the vehicle after you pay off the debt. However, if the car has been in a serious accident before, it will never be the same again and applying for a loan is likely to be a bad decision for you.